(530) 589-2515 | info@atlasfa.com

WHAT BUSINESS OWNERS SHOULD KNOW ABOUT CALSAVERS

What is

CalSavers?

CalSavers is a law mandating all California business owners with 5 or more employees to provide a retirement plan to their employees. The mandate is effective starting September 30th 2020, and requires business owners to either sponsor a 401(k) plan (or other qualified retirement plan) or adopt the state-run CalSavers retirement plan.

HOW DOES THE CALSAVERS PLAN WORK?

The CalSavers plan is a payroll-deducted Roth IRA that is run by the state of California. If an employer adopts the CalSavers plan, all their W-2 employees are eligible to participate (including part-time workers). The program is auto enrolled at 5%, which means that unless employees proactively opt out, they will be automatically enrolled to contribute 5% of after-tax income into the plan.

WHO CAN PARTICIPATE IN THE CALSAVERS PLAN?

Because the CalSavers plan is a Roth IRA, there is an income cap for participation—only employees who make less than $135,000 per year can participate. This means any employee (including the owner(s)) who make more than $135,000 per year can’t contribute to the CalSavers plan at all! A 401(k) plan has no income cap for participation, so employees and owners can all participate, regardless

of income.

WHAT FEATURES ARE INCLUDED IN THE CALSAVERS PLAN?

The CalSavers plan includes the following features:

- Auto-enrollment at 5% (i.e. employees will be automatically enrolled to contribute 5% in the plan unless they proactively opt out annually)

- Auto-escalation (i.e. employee contributions will be automatically increased by 1% annually (up to 8%) unless they proactively opt out annually)

- Annual contribution maximum of $6,000

- Roth only contributions (no pre-tax option)

- Does not allow loans

- Does not allow employer contributions

- Limited to employees with annual income < $135,000

DO EMPLOYERS HAVE TO OFFER THE CALSAVERS PLAN?

California business owners do have to offer a retirement plan, but it doesn’t have to be the CalSavers Plan. Business owners who offer a 401(k) (or other qualified retirement plan) are exempt from the mandate. Other qualified retirement plans could include 403(b), SEP IRA, and SIMPLE IRA.

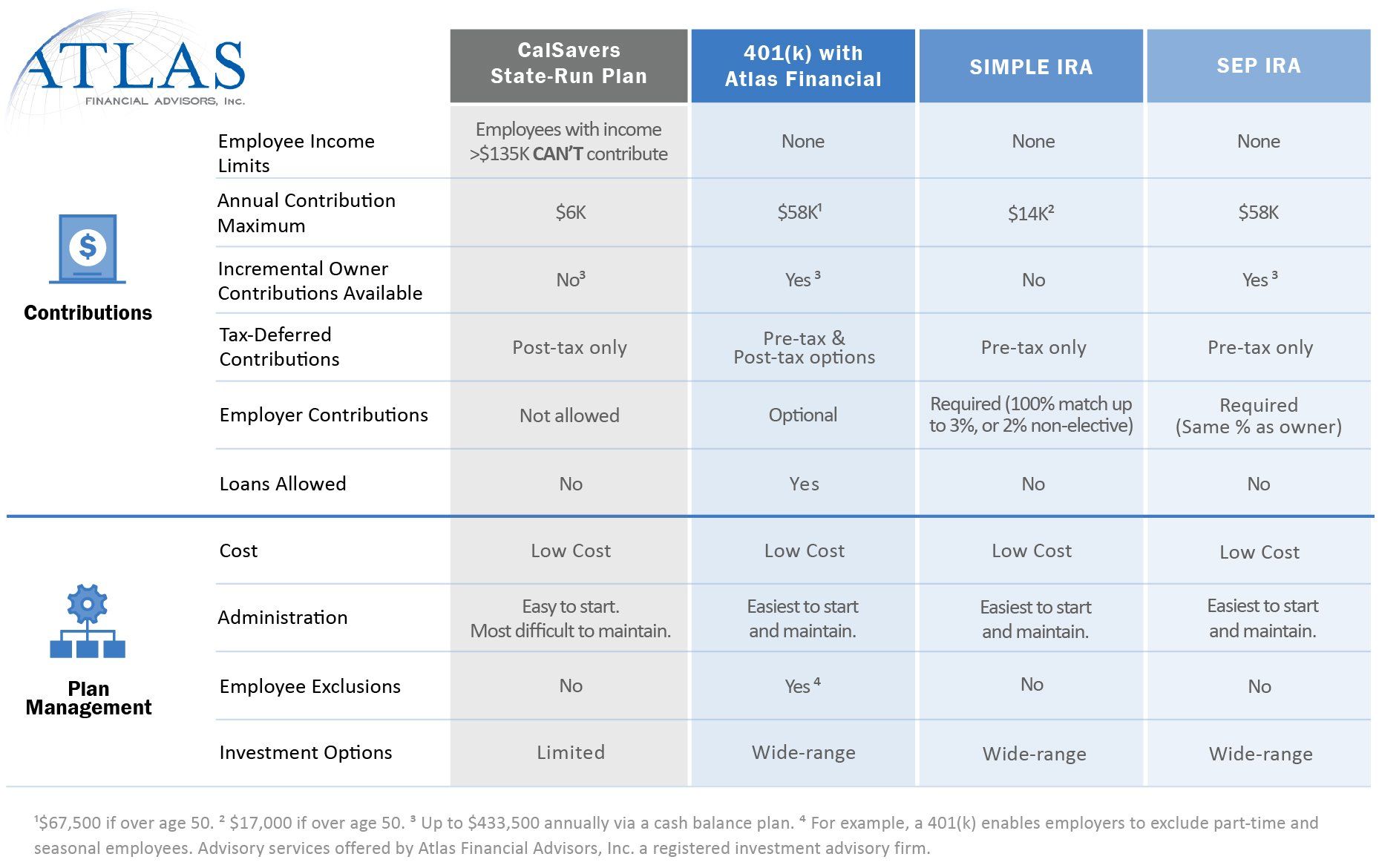

HOW DOES CALSAVERS COMPARE TO OTHER PLAN OPTIONS?

A 401(k) plan allows employees and the business owner(s) to save significantly more than the CalSavers plan. A 401(k) also includes a profit-sharing option and allows for combined employee and employer contributions up to $57,000 a year or $63,500 if age 50 or older. But the CalSavers plan only allows participants to save up to $6,000 per year. This may not be enough to help you and your employees achieve your retirement goals.

Furthermore, a 401(k) can have more plan types added on to help you save more when your business is ready. Here’s an example comparing your potential savings with the CalSavers plan vs. a 401(k) with profit sharing and a 401(k) with profit sharing and Cash Balance Plan.

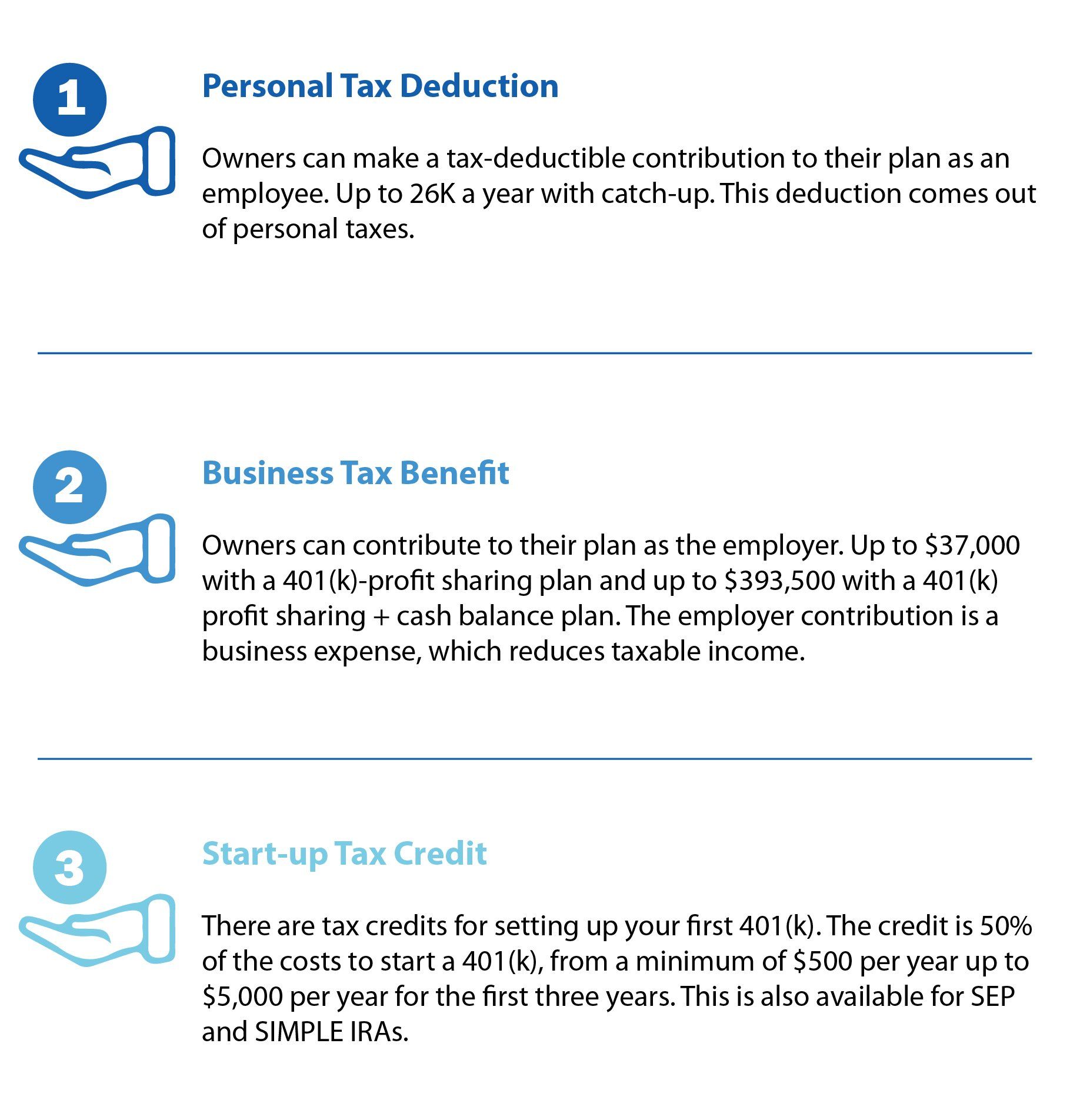

When it comes to saving money on taxes, there is no competition between an Atlas 401(k) plan and the CalSavers plan. This is because the CalSavers plan only allows for Roth (post-tax) contributions, whereas a 401(k) plan allows for pre-tax and Roth contribution options. This means there is no tax deduction on contributions to a CalSavers plan. On the other hand, contributions to a 401(k) plan can be either pre-tax or post-tax, which means the participant gets to decide.

Contributions grow tax-deferred in both plan options.

A 401(k) provides business owners three ways to save on taxes:

DOES CALSAVERS APPLY TO ALL BUSINESSES?

CalSavers applies to any employer who has 5 or more W-2 employees in California. This includes non-profits, as well as out of state businesses with employees who reside in California.

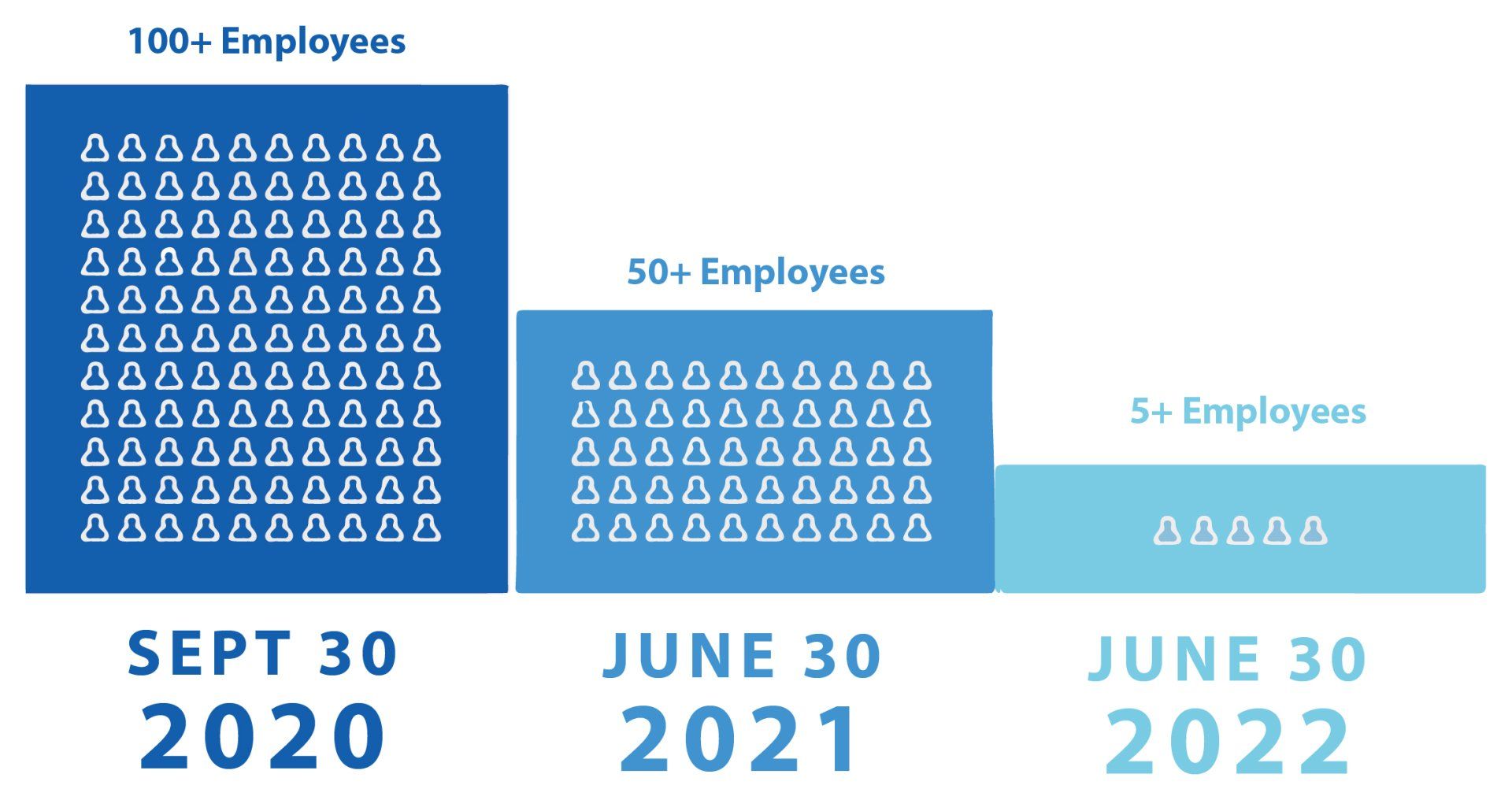

WHEN IS THE DEADLINE TO IMPLEMENT A RETIREMENT PLAN IN CALIFORNIA?

The deadline to implement a retirement plan in California depends on how many W-2 employees your business has:

WHAT ARE THE PENALTIES FOR NON-COMPLIANCE WITH CALSAVERS?

Companies who fail to comply with the CalSavers mandate could be subject to a fee of up to $750 per eligible employee.

DO EMPLOYEES HAVE ANY COMPLIANCE RULES TO MANAGE WITH CALSAVERS?

It is important to note that employees themselves may deal with compliance issues with the CalSavers plan. It is up to the individual participant to determine

if they make too much to contribute. This means if a participant contributes to their retirement account and then find out they

make too much money to be eligible, they could be subject to penalties and fees.

MUCH DOES CALSAVERS COST?

The CalSavers plan cost ranges from .82% to .95% of assets; this fee is deducted from each employee account balance. For example, if an employee has $100K in the retirement plan, $820-$950 a year will automatically be deducted out of their balance. There is no direct cost to the employer, but there are many ongoing tasks the employer must perform to administer the CalSavers plan.

CAN PARTICIPANTS TAKE A LOAN FROM THEIR CALSAVERS ACCOUNT?

The CalSavers plan doesn’t allow loans. When life happens, sometimes it can make sense for a participant to borrow against their retirement savings. If you, the employer, choose, a 401(k) plan can offer a safety net to participants, including owners who participate in the plan, in the form of 401(k) loans. These loans can be used to finance a new business venture, or even provide short-term relief when the unexpected occurs—like the COVID-19 pandemic.

WHAT DO EMPLOYERS HAVE TO DO TO ADMINISTER THE CALSAVERS PLAN?

CalSavers creates significant administrative burden for businesses. Business owners are busy, so when to comes to selecting a retirement plan, ease and simplicity are very important. Starting a 401(k) with Atlas Financial Advisors, Inc. is hassle-free because of our ‘do it for you’ approach. The same can’t be said for the CalSavers plan. The following is a list of annual tasks that must be completed by the business or employer every year in a CalSavers plan:

- Submit an employee census to CalSavers annually

- Track eligibility status for all employees

- Provide enrollment packets to all employees 30 days after date of hire

- Track whether each employee has opted in or out

- If employee doesn’t opt out within 30 days of notification, set up 5% payroll deduction

- Answer questions from employees who have been auto-enrolled

- Manually auto-escalate all employees annually (unless they’ve opted out)

- Repeat auto-enroll process annually for all employees who have opted out

- 6-month look-back for auto-escalation:

- Track if employee has been participating for 6 months with no auto-escalation

- Provide 60-day notice that they will be auto-escalated Jan 1st if they do not opt out again

- Hold open enrollment every 2 years

- Auto-enroll anybody who hasn’t been participating for at least 1 year (these have to be tracked)

Atlas Financial provides affordable, hassle-free solutions that reduce the administrative burden on employers. Explore your options. Reach out today.

Starting a retirement plan is exciting. It’s one of the most powerful savings tools the government gives business owners and employees. Complete the form below to lean more about how we can help.

LEARN MORE

We will get back to you as soon as possible

Please try again later

Newsletter

Privacy Policy Disclosures Form CRS

Copyright © 2021 Atlas Financial Advisors. All rights reserved. Advisory services offered by Atlas Financial Advisors, Inc. A registered Investment Advisor.